Empowering,

and powered by, you.

We’re a national financial co-op that believes people are powerful when we work together.

4.95

12-Month High Yield Rate CD

Maximize your savings growth.

Ready. Set. Save! Right now, you can lock in a great rate with our limited-time 12-month CD1. If interest rates go up during your CD term, you can maximize your savings growth with a one-time rate bump1.

We’re a financial co-op

owned by members.

Because we’re owned by our neighbors and not outside stockholders, we are able to invest our profits in our members and their communities. The shares of profit we make go back to them in the form of reduced fees, competitive interest rates, and community investments.

Member Rates

CERTIFICATES

as high as

4.95

%

APY*

HOME LOANS

as low as

6.935

%

APR**

CREDIT CARDS

as low as

13.24

%

APR**

*APY=Annual Percentage Yield

**APR=Annual Percentage Rate

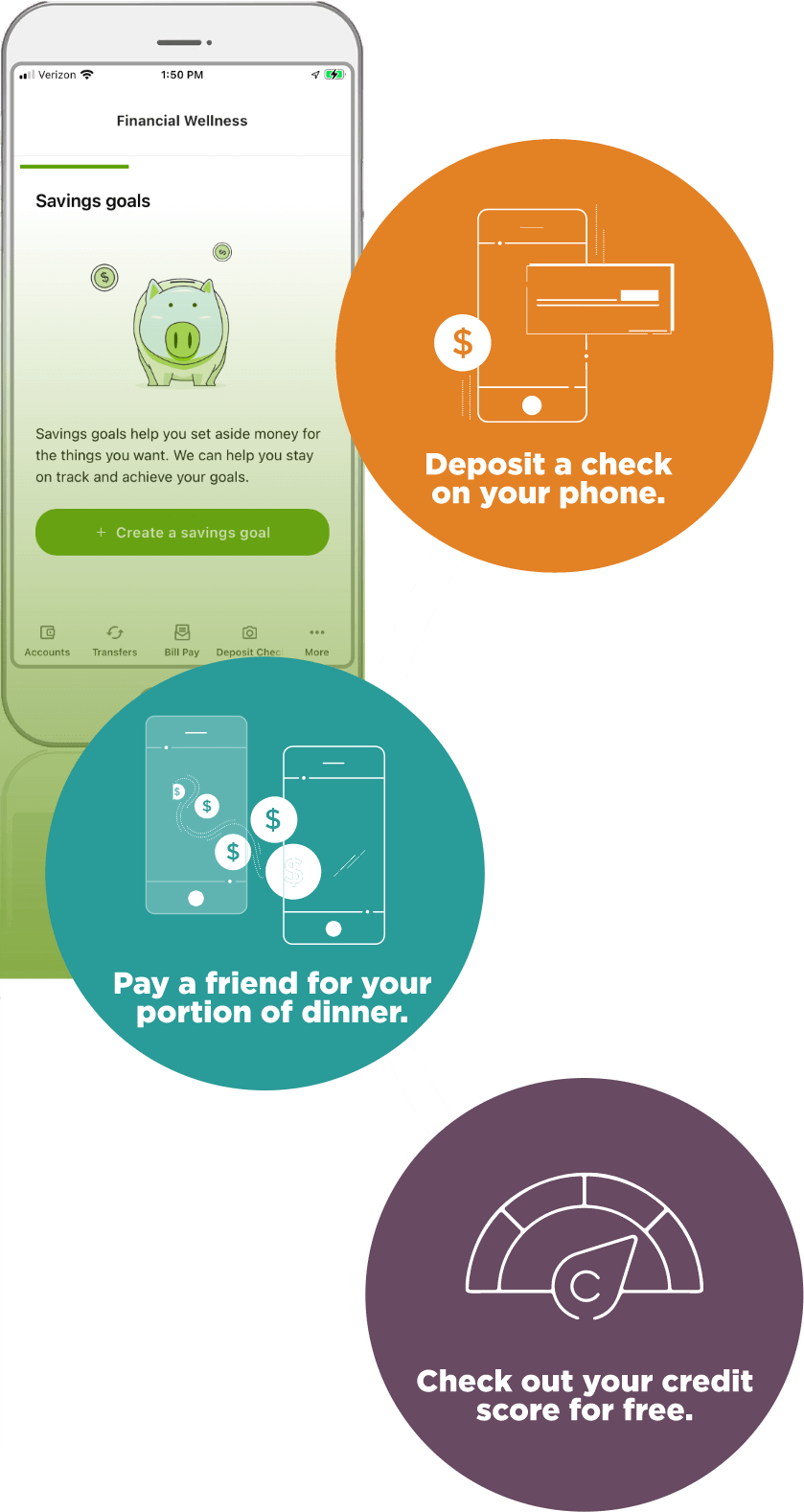

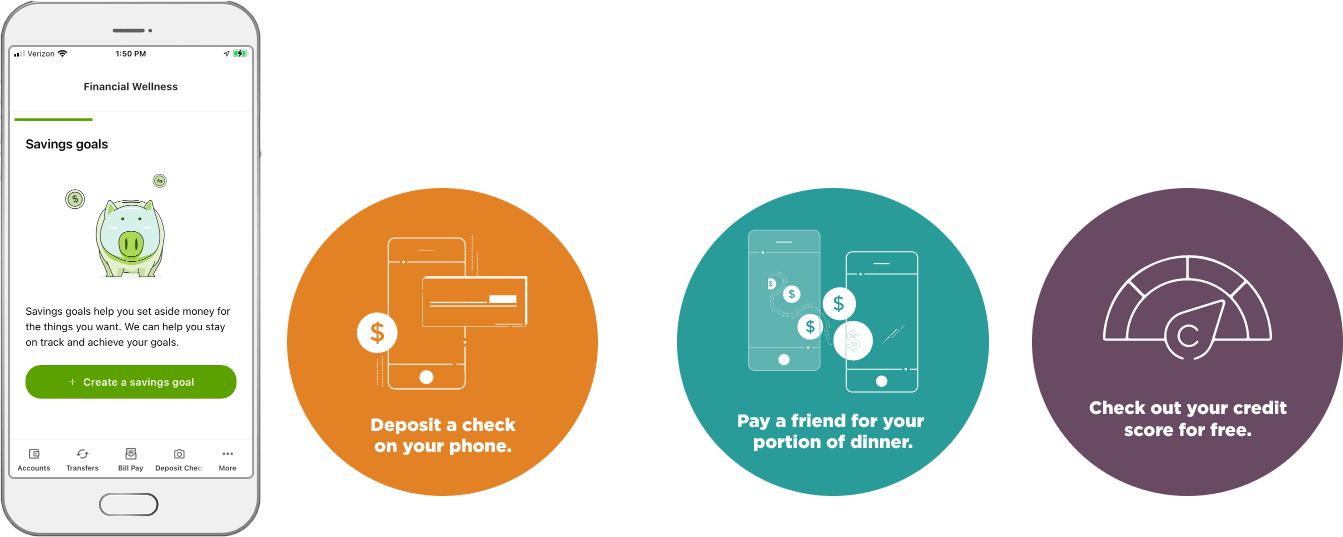

Full-service banking, wherever you are.

Bank from the comfort of your devices and manage multiple accounts all in one place with our digital banking platform.

Full service banking, wherever you are.

Bank from the comfort of your devices and manage multiple accounts all in one place with our digital banking platform.