What You’ll Learn

- Find out how Salal members can access their tax information and 1099 forms online or via mobile banking, as well as how to find their total interest earned.

Somehow, some way, it’s that time of year again. Yeah, we’re talking about tax season. That means sooner or later you will start to gather together your documents and tackle your taxes (this year’s tax filing deadline is April 15, 2024, by the way). So, here’s a quick guide on where to find your Salal tax information.

Somehow, some way, it’s that time of year again. Yeah, we’re talking about tax season. That means sooner or later you will start to gather together your documents and tackle your taxes (this year’s tax filing deadline is April 15, 2024, by the way). So, here’s a quick guide on where to find your Salal tax information.

When Will Your Tax Info Be Ready?

For members who have enrolled in eStatements, your tax information will be available within digital banking starting January 31. Simply log in to your account to view your documents. If you aren’t enrolled in eStatements, we will be mailing your 1098 and 1099 forms on or before January 31, 2024.

Note that we only create 1098 and 1099 forms if an account meets a certain minimum dollar amount threshold. If you have questions about the threshold for your account(s), give us a call at 800.562.5515.

How to Access Your Tax Statements in Mobile or Online Banking

If you’re enrolled in Mobile or Online Banking and have already signed up for eStatements, here’s where to find your tax statements.

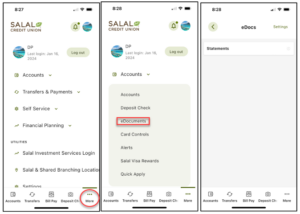

In Your Mobile Banking App:

Sign into your Mobile Banking app and tap the More button in the bottom navigation bar. From the mobile menu, select Accounts. From the Accounts drop-down, select eDocuments and then select Statements.

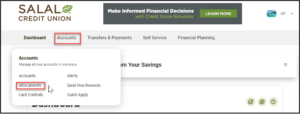

In Online Banking:

On your desktop or laptop, sign into Online Banking. Select Accounts in the top navigation bar. From the Accounts drop-down menu, click eDocuments and then select the Statements tab to view your 1098 or 1099 forms.

Finding Out Your Total Interest Earned or Paid

To find out how much interest you earned on an account in 2023, sign into Online Banking (this feature is not available in the Mobile app). Select Accounts in the top navigation bar. From the Accounts drop-down menu, click Accounts again, then select the Tax Information tab. Click on Interest Earned or Interest Paid to see a breakdown by account.

Questions?

Need a little help finding your tax information? Give us a call at 800.562.5515 or send us a secure message in Mobile or Online Banking.