In the complex and ever-changing world of cannabis banking, experience really does matter. Since 2014, Salal Credit Union has been a national leader in providing financial services for the licensed and regulated cannabis industry. Looking to turn your cannabis business vision into reality? Let’s talk.

Robust checking and savings solutions customized to fit the needs of your cannabis businesses.

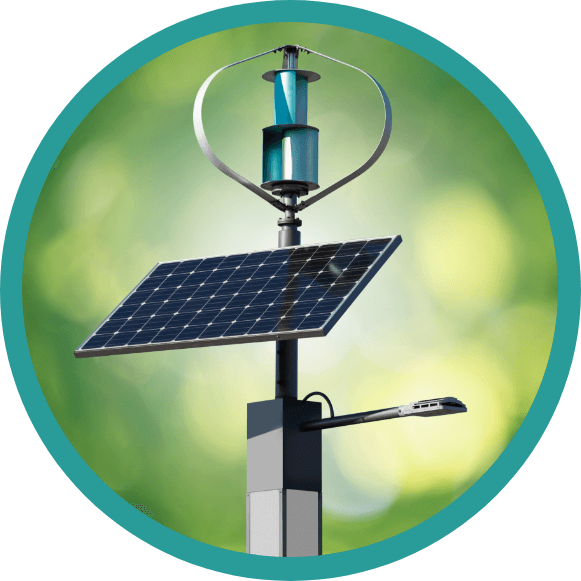

Affordable financing and flexible terms for everything from equipment investments to commercial solar systems.

From basic checking to home loans, cannabis industry professionals have access to our full suite of personal banking services.

For a cannabis business, it pays to bank with a credit union that understands the unique challenges faced by your industry. Our dedicated business services team develops checking and savings solutions tailored to meet the unique needs of your business, with experienced and responsive support to keep your company moving forward. Our cannabis business banking services include:

From expanding your operations to managing cash flow, cannabis businesses need dependable access to financing just like any other industry. Our cannabis business lending program features competitive rates with quick processing and funding times, along with a proven regulatory track record.

Our commitment to your success goes beyond banking. We know it can be a challenge for plant-touching and ancillary cannabis businesses to find services you can depend on. With our trusted referral partners, you can keep your business running smoothly and leave the vetting to us.

Let us know the best way to contact you and a Salal Business Banking Specialist will get back to you.

All Salal accounts and loans are subject to credit approval. Salal Credit Union membership required.

![]()

Please be advised that you are leaving Salal Credit Union’s website. This link is provided for your convenience, but know that Salal doesn’t endorse or control the content of third party sites. Linked sites may have privacy and security policies different from our own. Salal does not represent you or a third party if you enter into a transaction. Do you wish to continue?

Fill out the form below and one of our Mortgage Advisors will get back to you within 1-2 business days. Their recommendations come with no obligation.

"*" indicates required fields

Fill out the form below and one of our Mortgage Advisors will get back to you within 1-2 business days. Their recommendations come with no obligation.

"*" indicates required fields

Fill out the form below and one of our Mortgage Advisors will get back to you within 1-2 business days. Their recommendations come with no obligation.

"*" indicates required fields

Select your state below to schedule a call with the Salal Dealer Direct representative in your region.